The Cowan Trade Credit Team brings over 60 years of combined experience. We deeply understand Trade Credit and the unique challenges businesses face in managing credit risks and business growth. We empower our clients to mitigate credit risks and achieve their long-term business goals confidently. Our Underwriting, Risk Control and Claims teams have decades of experience working directly with small businesses. Payment history is a big deal because it’s a direct indicator of how reliably a customer will pay you back. If they’ve got an excellent track record, we bump up the limit to reflect that trust.

Why choose Coface Trade Credit Insurance?

Accounts Receivable Insurance, a vital tool for businesses across the US, offers this security. At Hotaling Insurance Services, we understand the importance of safeguarding your company’s financial backbone. This insurance shields you from unexpected customer insolvency, ensuring business continuity and stability. Some companies neglect to get accounts receivable insurance because of the cost. In the short term, going without AR insurance may save you a little money.

- For instance, they’ll evaluate things like economic conditions and typical payment behaviors within your sector.

- Properly managing your homeowners insurance with Accounts Receivable Coverage provides peace of mind and financial security for your home-based business.

- Firstly, it covers direct losses from non-payment, including situations where customers fail to pay due to bankruptcy, insolvency, or contractual issues.

- For example, if you are selling products internationally and a buyer in another country goes bankrupt, the policy can help recover your unpaid funds.

- Accounts Receivable Coverage endorsements in your homeowners insurance policy can provide essential protection for these vital business records.

- It also streamlines transactions by eliminating the need for foreign clients to handle prepayments or secure letters of credit, making cross-border business dealings smoother and more efficient.

A Guide to Accounts Receivable Insurance Coverage

But, firms that often take in new buyers or work in quick-change fields might find the three-month checks and data needs hard. Covers the loss in value and extra costs from municipal laws regarding the construction or repair of damaged buildings after an insured event. Discover Lendtek’s lender network offering a wide variety of funding options, with funding times as quick as 24 hours. Enjoy zero annual or late fees, 1.5% cashback on all business purchases, and a flexible credit limit with the Stripe Corporate Card. If you have a recourse agreement, the responsibility falls back on you to purchase the unpaid invoice.

- The system also needs info about how good your customer’s credit is and any big changes in what you do.

- This insurance shields you from unexpected customer insolvency, ensuring business continuity and stability.

- It gives a positive signal to your lenders, making them more open to financing you on favorable terms.

- P2Binvestor provides asset-backed lines of credit for eligible borrowers.

- CNA Connect includes a range of coverages tailored to the specific risks of small business owners — many of which aren’t typically offered in today’s competitive marketplace.

- Breakout Finance makes it easy to get the funding you need with your unpaid invoices.

- We also offer non-payment coverage for short-term trade-related receivables.

Protection Against Political and Economic Instability

Helps provide a plan for business continuity in the event of the premature death of a business owner. Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these How to Start a Bookkeeping Business entities. Riviera Finance serves business of all sizes in a variety of industries in the United States and Canada.

- Your full insurance cost adds up the money owed in each group using the set rate.

- Many insurers provide indemnity coverage ranging from 80% to 100% of the debt amount.

- It protects against the risk of non-payment by foreign customers or clients due to factors like political instability, currency fluctuations, or foreign government actions.

- Simply submit your invoices online, and once they are verified, Breakout sends the agreed upon cash advance.

- This creates a robust risk management framework where insurance protects against unavoidable losses while automation reduces their frequency and severity.

- This type of insurance can protect small and mid-sized organisations from customers who fail to pay their dues on time.

- If you have any questions or need to add this endorsement to your policy, contact your insurance agent for guidance.

What their factoring process looks like

- Premiums for trade credit insurance typically average about 0.25% of insured revenue.

- To protect accounts receivable, businesses can perform regular credit checks on customers and establish clear credit terms.

- However, higher coverage limits also come with higher premiums, so it’s important to strike a balance between the two.

- Premiums typically range from 0.2% to 1% of the accounts receivable portfolio, and domestic coverage often costs 0.5% or less of total sales volume.

Riviera promises fast funding within 24 hours of verifying and approving invoices. However, the overall application process can be lengthy (several business days). However, businesses that are willing to wait a few days accounts receivable insurance for funding will like what Riviera has to offer. P2Binvestor has an easy application process, and you’ll work with a dedicated account manager that offers support throughout the process. It’s worth noting that the application process can be a bit lengthy, with underwriting taking an average of five to ten days. The company does have stricter eligibility requirements, making this a suitable option for established businesses with high annual revenue.

Comprehensive Risk Management

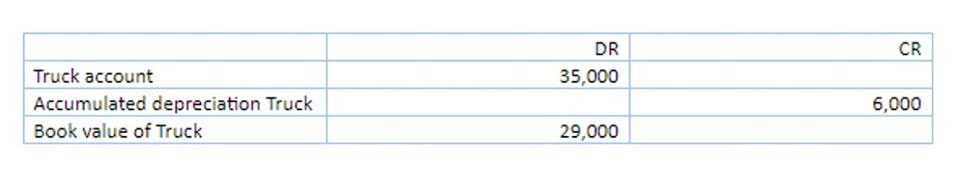

Because records damage is different from other types of contribution margin property damage (particularly if they are electronic records), insurance companies use a specific formula to calculate the losses. Although the exact formula differs between insurers, most companies use the total accounts receivable for the 12 months before the loss, and then divide that number by 12. Coverage limits are capped at a maximum of ninety percent (90%) of the approved customer credit limit and determined by factors including prior fiscal year’s sales and credit worthiness of customers. CNA Connect includes a range of coverages tailored to the specific risks of small business owners — many of which aren’t typically offered in today’s competitive marketplace. A formal request made by the policyholder (you) to your insurance company for coverage or payment for a covered loss. A fire breaks out in your home, destroying your home office and the accounts receivable records stored there.